Are you dreaming of white-sand beaches, affordable living, and a new adventure after retirement? Before you pack your bags, discover the hidden challenges of retiring in Southeast Asia that could make or break your financial independence and quality of life.

Thinking of Retiring in Southeast Asia? Uncover the Hidden Risks

Southeast Asia entices countless retirees each year with its vibrant cities, beautiful beaches, and a lower cost of living compared to many Western countries. While the prospect of retiring in southeast asia is undeniably exciting, moving to a foreign country for your golden years comes with specific risks that even the most seasoned expats can overlook. From navigating complex visa rules to adapting to a dramatically different healthcare system in asia, failing to plan meticulously can turn a dream retirement destination into a stressful ordeal.

If you’re considering an asian country like Thailand, Vietnam, Malaysia, or Cambodia as your place to retire, it’s crucial to look past the travel brochures and glossy social media images. The reality is that many retirees face higher costs, unmet healthcare expectations, and logistical difficulties when settling abroad. Early retirement in Southeast Asia needs more than just a resilient spirit; it demands robust research and solid planning. Let’s get ahead of common pitfalls and safeguard your financial independence and well-being before you retire abroad.

Why Consider Southeast Asia for Retirement?

Retiring in southeast asia has surged in popularity among westerners seeking warmer climates, cultural adventure, and an affordable lifestyle. The region’s diverse countries to retire offer incredible food, stunning natural scenery, and a welcoming expat community. Quality of life is further boosted by the slower pace of life, direct connections to international destinations, and a range of spots that fit both frugal and luxurious budgets. Whether you crave cosmopolitan living in major cities like Bangkok and Kuala Lumpur or serene coastal life in Da Nang or long bay, there’s an asian country for every retirement dream.

Strategic economic growth and improved infrastructure mean that retiring in southeast asia is easier than ever, especially if financial planning is done right. Many places to retire here cater specifically to foreign retirees, offering retirement visas, affordable real estate, and strong support networks for newcomers. But with these perks come details you can’t ignore, such as legislative complexities and differences in the healthcare system in asia. Understanding the full picture will help you choose the best asia to retire for your unique needs and aspirations.

The Allure of Countries to Retire in This Region

Southeast Asia’s appeal as a retirement destination lies in its balance of affordability, comfort, and adventure. Countries like Thailand, Vietnam, Malaysia, and Cambodia offer a unique mix of urban amenities and natural wonders. For many, the idea of early retirement here means stretching savings further without compromising on lifestyle. Expat-friendly amenities such as international schools, private hospitals, and dedicated retirement communities make integration easier than ever.

Beyond the lower living costs, retirees discover the joys of friendly locals, strong community ties, and opportunities to explore diverse cultures, languages, and cuisines. Whether it’s the tranquility of beautiful beaches or the excitement of bustling city markets, retiring in southeast asia presents endless possibilities—provided you sidestep the common pitfalls and plan with care.

What You'll Learn About Retiring in Southeast Asia

- Key retirement mistakes most expats make and how to avoid them

- Practical advice on choosing the right asian country to retire

- Essential information on health care, financial planning, and living arrangements

- Insights on the safest place to retire in Southeast Asia and local regulations

Quick Comparison Table: Best Countries to Retire in Southeast Asia

| Country | Cost of Living | Health Care | Residency Requirements | Cultural Fit | Place to Retire Highlights |

|---|---|---|---|---|---|

| Thailand | Low to Moderate | Excellent private hospitals, affordable insurance | Retirement visa with proof of income/savings | Strong expat network, easy-going | Bangkok, Chiang Mai, beautiful beaches |

| Vietnam | Very Low | Good in major cities, improving elsewhere | Long-stay visas possible, complicated property rules | Friendly locals, vibrant culture | Da Nang, Hoi An, long bay |

| Malaysia | Low | High-quality private healthcare, English spoken | Malaysia My Second Home visa (MM2H) | Multicultural, easy adjustment | Penang, Kuala Lumpur |

| Cambodia | Very Low | Sufficient in cities, limited elsewhere | Easy long-term visa, few restrictions | Simple lifestyle, emerging expat scene | Phnom Penh, Siem Reap |

13 Critical Pitfalls When Retiring in Southeast Asia

1. Underestimating the True Cost of Living When Retiring in Southeast Asia

Many retirees are attracted to the slightly romanticized "dollar goes further" narrative, but in reality, cost of living can fluctuate significantly across southeast asia. Daily expenses vary between major cities and rural areas, with living costs in Bangkok, Da Nang, or Kuala Lumpur rising steadily—especially for those seeking western standards. While many asian countries boast affordable street food and housing, imported goods, quality health insurance, or special diets can impact your savings rate.

Compared to retiring in another foreign country, Southeast Asia shines for frugal lifestyles but can surprise those used to their home country’s conveniences. It’s crucial to budget for cost of living in both the high season (when tourist demand spikes) and off-peak times, as higher costs for utilities, travel, and international schools can add up. Proactive financial planning along with regular reviews of living costs will ensure your money lasts, especially for those seeking financial independence or early retirement abroad.

- Breakdown of living expenses in popular countries to retire

- Comparison between retire in Asia and retire abroad costs

2. Choosing the Wrong Asian Country for Your Needs

Each asian country offers a distinct lifestyle, legal landscape, climate, and pace of life. Choosing a retirement destination based on online trends, without thorough research, is a pitfall that can lead to regret. The best asia to retire really depends on factors like healthcare quality, safety, accessibility, language barriers, and cultural fit. For instance, Malaysia and Thailand are popular among retirees for their modern amenities and supportive expat communities, while Cambodia offers a more relaxed lifestyle but fewer urban resources. Instead of following the crowd, create a checklist that matches your dreams to practical realities. Consider what makes a place to retire personally rewarding: do you thrive in a bustling city, or would a coastal village suit you better? Always visit your shortlisted countries to retire before making a decision, and talk to other expats for expert advice on the pros and cons of each locale.

- Best asia to retire locations for different lifestyles

- Pitfalls of picking a trendy place to retire without research

3. Neglecting Health Care Options and Insurance

Navigating the healthcare system in asia is one of the most complex challenges for retirees, especially those with ongoing medical needs. While private hospitals in Thailand, Malaysia, and Vietnam offer excellent care at a reasonable price, public healthcare may be lacking, especially outside major cities. Health insurance isn’t always included with residency and can involve higher costs for older expats, so researching available plans and choosing comprehensive coverage is crucial.

The standard of healthcare quality can differ even within a single country—what’s available in the capital might be hard to find elsewhere. Always compare the quality, cost, and language service of healthcare options across countries to retire, and have contingency funds in place for emergencies or repatriation if the need arises.

- Quality and cost of health care in southeast asia

- How health care systems compare across countries to retire

4. Failing to Secure Sufficient Residency or Visa Status

Each southeast asian country has its unique – and sometimes changing – set of visa or residency requirements. Whether you’re seeking a retirement visa or an investor visa, compliance is key to long-term security. Overstaying or misjudging visa rules can result in fines or forced departures, jeopardizing your chosen place to retire.

Retirees should consult local legal resources or expert advice to stay updated on the latest requirements, renewal protocols, and acceptable forms of proof for income, savings, or property ownership. Building a strong foundation in legal residency ensures stability and peace of mind as you start your life abroad.

- Navigating visa requirements for retire in Asia

5. Misjudging Safety and Security in Your Place to Retire

Perceptions of safety in southeast asia can differ from reality. While many areas are extremely safe for foreigners, crime rates, political climates, and natural disaster risks can vary between regions and countries to retire. For example, Thailand and Malaysia enjoy stable environments and have dedicated tourist police, while other locations might present challenges.

Research up-to-date crime and healthcare statistics, avoid high-risk areas, and opt for gated communities when possible. Reliable information, combined with sensible daily precautions, enhances your overall safety and ensures a worry-free retirement abroad.

- The safest country in Southeast Asia for retirees

6. Overlooking Local Laws and Cultural Norms in Southeast Asia

Failing to adapt to local etiquette and regulations is a common pitfall for expats retiring in southeast asia. Every asian country has traditions and legal nuances—such as modesty expectations, religious customs, and property laws—that may differ dramatically from those in your home country.

Taking time to learn these norms shows respect and can help you avoid fines or legal issues. Seek expert advice from locals or established expat groups on sensitive topics, such as gift-giving, housing rules, or acceptable public behavior, to fully enjoy your new retirement destination.

- Respecting traditions in each asian country to avoid legal troubles

7. Inadequate Financial Planning and Currency Issues

Currency fluctuations and unfamiliar banking procedures can sabotage even the most careful retirement budgets. Exchange rates, international transfer fees, and restrictions on foreign bank accounts can diminish your monthly income and erode the savings rate you’ve built for early retirement.

Develop a reliable strategy for holding, transferring, and managing funds. Investigate local bank options, currency hedging, and international banking partners before arrival to minimize hidden fees. Keeping in touch with a financial planner familiar with the cost of living in your retirement destination will support your financial independence and stability long-term.

- How to manage exchange rates and transferring funds when you retire abroad

8. Ignoring Tropical Climate Challenges in Countries to Retire

The dream of endless summer is appealing, but the tropical climate in southeast asia comes with hazards. Retiring in southeast asia means preparing for intense heat, humidity, and unpredictable monsoon seasons, which may trigger health issues or complicate travel and housing arrangements.

Mitigating these risks involves both practical solutions—like choosing properties with good insulation or air conditioning—and a willingness to adapt your routines. Stay informed about weather patterns, invest in health insurance that covers climate-related illnesses, and be proactive in adjusting your lifestyle with the seasons.

- Navigating health risks, monsoons, and heat while retiring in Southeast Asia

9. Planning Poorly for Family Visits and Connectivity

Distance from loved ones can make retiring in southeast asia isolating unless you evaluate connectivity before you move. Consider proximity to international airports, availability of direct flights, and the quality of digital infrastructure for video calls, banking, and more.

Prioritize locations with reliable internet, especially if you intend to manage bills or maintain work-from-home opportunities post-retirement. Easy accessibility and robust communication channels help maintain family ties and support networks—essential for long-term well-being in your new home abroad.

- Access to international airports, digital infrastructure in southeast asia

10. Failing to Build a Support Network When You Retire in Asia

Social integration is key to a happy retirement. Relying solely on fellow expats, or neglecting to build connections with local residents, often leads to loneliness or cultural frustration. Southeast asia boasts vibrant expat communities, language exchange groups, and volunteer opportunities—embracing these is vital.

Proactively seek out expat forums, participate in community activities, and consider learning the basics of the local language. Strong support networks and open-mindedness toward different cultures transform a foreign country into a second home and help smooth the sometimes rocky transition of retire in asia.

- Expat groups, community resources, and local language barriers

11. Not Understanding Healthcare Emergencies and Medical Evacuations

Even areas with good day-to-day health care can be challenging during major emergencies—especially in remote places to retire. It’s essential to have a clear health care evacuation plan, know your insurance’s evacuation coverage, and understand how quickly you can reach a major city or fly to your home country if needed.

Research the availability of air ambulances and nearby international-standard private hospitals before you retire abroad, especially if you have ongoing health conditions or limited mobility.

- Health care evacuation plans in countries to retire

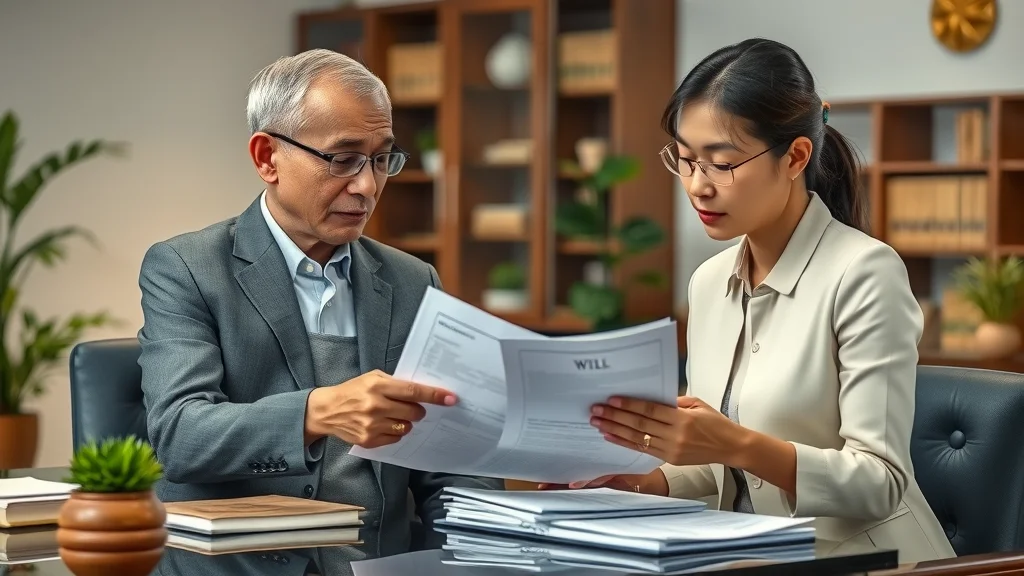

12. Overlooking Estate, Will, and Inheritance Planning

Property laws and inheritance processes are different in each asian country. Failing to update or properly register your will per local standards can lead to long legal battles for your heirs. Seek expert advice from legal professionals familiar with the country of your choice to ensure that estate planning, property rights, and asset transfers are valid and efficient.

Having the correct documentation in place is essential—especially for transferring property or finances across borders—so your intention is honored, and your family is protected from unnecessary stress.

- Legal processes in each asian country for property and wills

13. Relying on Social Media Myths About Retiring in Southeast Asia

Social media and influencer channels often paint an unrealistic picture of early retirement in Southeast Asia. While there are hundreds of idyllic beaches, affordable street food, and vibrant street markets, not every day is an adventure. Glossing over the realities—such as healthcare pulls, higher costs for imported goods, and bureaucratic headaches—leads to disappointment for those who haven’t done their homework.

Use real expat forums, government advisories, and seasoned traveler blogs to set accurate expectations before you retire abroad. Fact-checking with trustworthy, on-the-ground sources ensures you start your new chapter with clarity and confidence.

- Common misconceptions about the reality of retire in Asia

Expert Quotes: Real Expats Share Their Lessons About Retiring in Southeast Asia

"Many westerners assume they know the cost of living, but hidden fees surprised me." – John, retired in Thailand

"Good private health care is available, but you must plan for emergencies and language differences." – Maria, retiree in Malaysia

Lists: Quick Tips to Enjoy Retiring in Southeast Asia Successfully

- Top factors to prioritize: safety, healthcare, lifestyle, expat community, and legal status

- Checklists for moving documentation and insurance before you retire abroad

Best Places to Retire in Southeast Asia for 2024 – Real-life footage of neighborhoods, cityscapes, natural beauty, and expat lifestyle moments, highlighting cost of living and local culture.

People Also Ask: Key Questions on Retiring in Southeast Asia

How much money do you need to retire comfortably in Vietnam?

The amount you need to retire comfortably in Vietnam varies by city and lifestyle. On average, a single retiree in a major city like Da Nang or Ho Chi Minh City can live well on $1,200–$1,800 per month (about $14,400–$21,600 annually), covering housing, food, health care, and entertainment. Living costs in rural areas are even lower, while international apartments and imported goods in top districts can push expenses higher. Always factor in personal medical needs and lifestyle choices for your final number.

Where is the best place to retire in Southeast Asia?

The best countries to retire in Southeast Asia—based on climate, cost, and expat satisfaction—include Thailand, Malaysia, and Vietnam. Thailand stands out for its affordable healthcare and strong expat networks in cities like Chiang Mai. Malaysia boasts great infrastructure and multicultural ease, especially in Penang. Vietnam offers ultra-low living costs and breathtaking natural scenery. Choose your retirement destination based on your need for urban amenities, safety, and community fit.

Is $100,000 enough to retire in Thailand?

$100,000 can fund an early retirement in Thailand for several years if you are careful with your budget and live modestly. On a $1,500 monthly income (about $18,000/year), your nest egg might last 5–6 years—possibly longer in smaller cities or with cost-saving strategies like using local markets and avoiding imported goods. For a long-term plan, combine your savings with recurring pension payments or social security for stability.

What is the safest country in Southeast Asia?

Malaysia consistently ranks as one of the safest countries in Southeast Asia, featuring low crime rates, political stability, and excellent healthcare. Thailand and Vietnam are also safe, especially in expat-majority areas and gated communities. Always refer to updated government travel advisories and expat forums for real-time safety information.

FAQs: Retiring in Southeast Asia

- What documentation is needed to retire in Asia? You typically need a valid passport, proof of income or savings, health insurance, and sometimes a police background check, though requirements vary by country.

- Can non-citizens own property in Southeast Asia? Rules differ by country; many allow long-term leases, but full ownership can be restricted for foreigners in countries like Thailand and Vietnam. Always check local laws.

- What health care options exist for expats? Excellent private hospitals operate in major cities, but quality and cost can vary; private health insurance is highly recommended for retirees.

- Do I need to learn the local language to retire abroad effectively? While not required, learning basic local phrases significantly enhances daily life and integration into the community.

Key Takeaways on Retiring in Southeast Asia

- Avoid common mistakes with careful planning and on-ground research

- Prioritize health care, visa, and safety to enjoy a rewarding lifestyle

- Choosing the right asian country to retire maximizes benefits and minimizes risk

Final Thoughts: Plan Wisely for a Secure Retiring in Southeast Asia Experience

With strategic planning and realistic expectations, retiring in Southeast Asia can deliver a safe, affordable, and enriching lifestyle.

Add Row

Add Row  Add

Add

Write A Comment